Allowable depreciation calculator

THX Tom Holman Xperiment creates the standards that movie theaters have to meet in order to become THX certificated. You didnt claim depreciation in prior years on a depreciable asset.

Double Declining Balance Depreciation Calculator

For each of the remaining years in the recovery period you take a full years deduction.

. Gone are the days of looking up formulas and blasting away on your physical calculator with a notepad to figure out your problem. You may use the depreciation calculator to calculate the depreciation amount. This document was issued in February 1995 as Chapter B3 of the Financial Management Manual for Counties Tribes and 51 BoardsIt is also designed to be liftable to serve as a stand-alone Allowable Cost Policy Manual for provider agencies and other users.

THX Max Recommended and Max Allowable Viewing Distance. Fannie Mae Cash Flow Analysis. THX recommends that a theaters last row of seats should provide a 36 plus viewing angle with all seats offering a viewing angle of 26 plus for certification.

If you hold the property for the entire recovery period a half-year of depreciation is allowable for the year following the end of the recovery period. How Loss Carryforward Works If your net operating loss for a year is limited you may be able to use all or part of that loss in future tax years through a process called loss carryforward. The same is true of software you will use for more than two years.

2020 IRS Depreciation Rate 27mile standard mileage rate 575. This applied regardless of when in the tax year you placed the property in service. Depreciation of equipment cannot be claimed as an allowable expense.

Depreciation recapture is the USA Internal Revenue Service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciationIn other words because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayers. Methods of depreciation as per Income Tax Act 1961 Based on Specified Rates. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available.

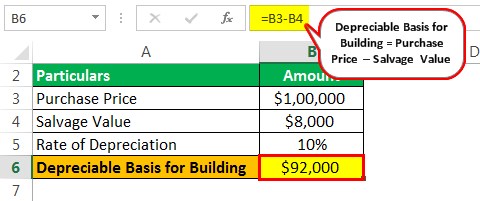

Written Down Value Method Block wise Straight Line Method for Power Generating Units. Straight-Line Method Rate of Depreciation Original Cost Residual Value Useful Life x 100. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

For equipment you buy and keep for business use such as computers you can only claim allowable expenses if you use cash basis accounting. Depreciation is handled differently for accounting and tax purposes but the basic calculation is the same. 1 lakh and 80 depreciation is prescribed for the asset and you charge only rs.

If you change your cooperative apartment to rental use figure your allowable depreciation as explained earlier. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. As per the Companies Act a maximum of 5 of the asset is allowable as residual value.

Line 44a X the IRS Depreciation Rate below. If you use traditional accounting you must use capital allowances. For eg if an asset is of Rs.

Depreciation is a method for spreading out deductions for a long-term business asset over several years. Calculator and Quick Reference Guide. If you use the actual expenses method and the vehicle was acquired new in 2021 the maximum first-year depreciation deduction including bonus depreciation for an auto in 2021 is 18200.

8 Tax-Advantaged Retirement Plans. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. This strategy doesnt work however because tax law requires that recapture be calculated on depreciation that was allowed or allowable according to Internal Revenue Code Section 1250b3.

Unlike Roths you can defer capital gains taxes up to allowable limits with traditional IRA or 401k contributions. Depreciation allowable as per Income-Tax Act 1961 Other allowable items Book Profit Maximum. At-risk rules limit the amount of business loss to the net allowable deductions for the business for the year including depreciation and tax amortization.

IRS Form 1040 Individual Income Tax Return. 20000 only not rs. Also any depreciation recapture must be recognized in the disposition year.

However even if youre not one of these there are still a few. Theyre among a short list of retirement plans classified as follows. Policy for Federal Awards 2 CFR Part 200.

The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemicNowadays only a few select groups of salaried home-based workers can still deduct relevant expenses. Assets are depreciated for their entire life allowing printing of past current and. You claimed more or less than the allowable depreciation on a depreciable asset.

W-2 Income from Self-Employment Only add back the eligible. In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of 18200 or 16380. Not Claiming Depreciation Wont Help It might seem reasonable that you could not claim a depreciation deduction to avoid paying the recapture tax.

Depreciation Calculator as per Companies Act 2013. Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. Date of Purchase of Asset Format DDMMYYYY.

Depreciation can be claimed at lower rate as per income tax act. The amount by which your disposable earnings exceed 30 times 725 is 28250 500 30 725 28250. Claiming catch-up depreciation is a change in the accounting method.

Youre changing from a depreciation method thats. If you make 500 per week after all taxes and allowable deductions 25 of your disposable earnings is 125 500 25 125. 30000 as depreciation in this case next year wdv will be considered as rs.

Calculator Academy Our mission is to provide the world with free and easy-to-use calculators to solve your daily problems. Depreciation methods are discussed in chapter 2 of this publication and Pub. Formula for Calculating Depreciation by Straight-Line Method.

Review these expenses carefully and individually as you may only add back the allowable add backs described not the total amount of expenses deducted for tax purposes. 946 The basis of all the depreciable real property owned by the cooperative housing corporation is the smaller of the following amounts. 4What is carrying amount.

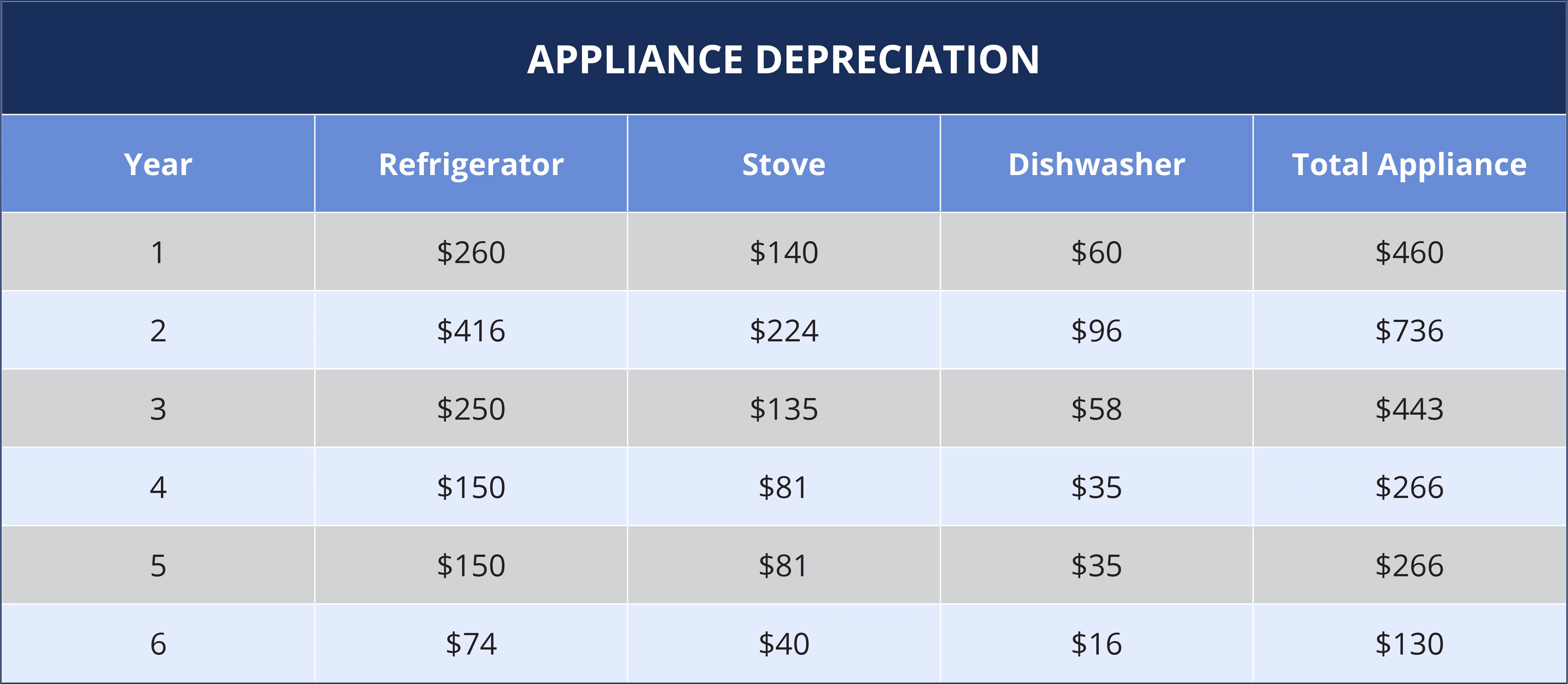

How To Calculate Depreciation Expense For Business

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

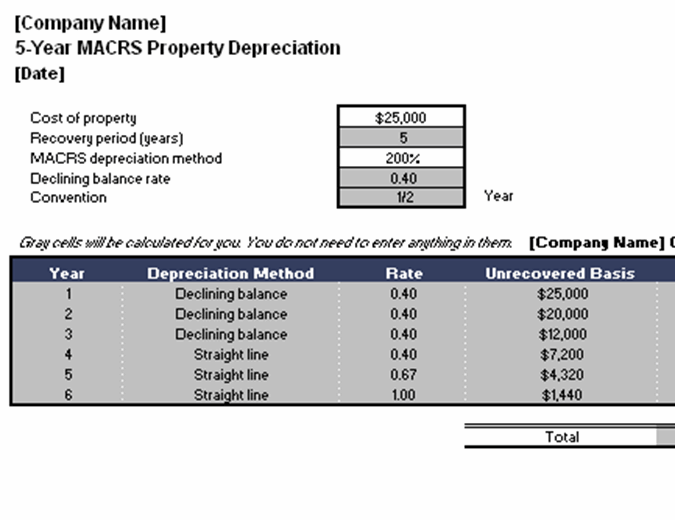

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Macrs Tables And How To Use

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Depreciation For Rental Property How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Depreciation Of Building Definition Examples How To Calculate

Depreciation Of Building Definition Examples How To Calculate

Rental Property Depreciation Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Depreciation Calculator

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Based On Irs Publication 946