18+ Principal interest

After a year of making minimum payments the minimum. SI 1300-1200 100 t SI Pr 100 1200 5100 167 years or 20.

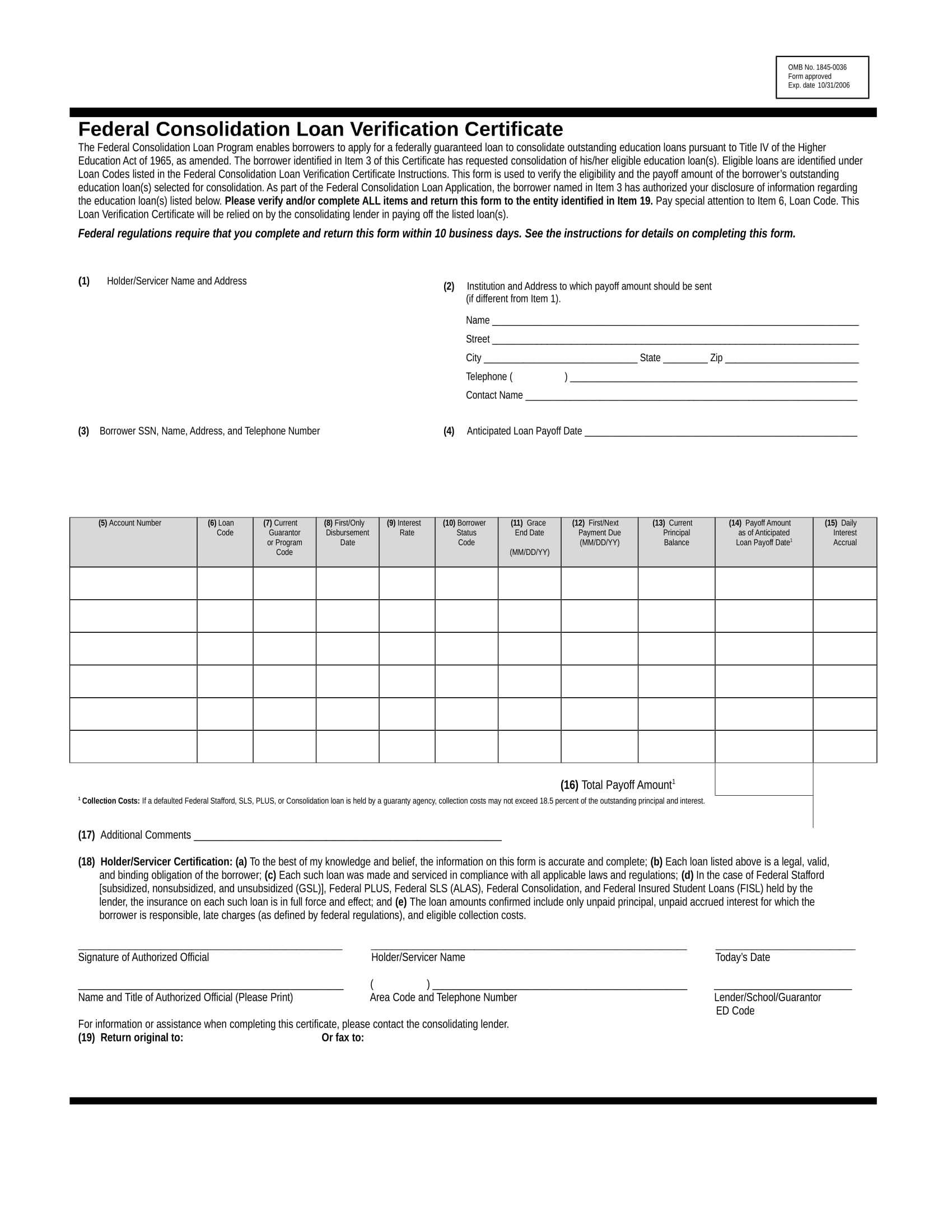

What Is A Loan Verification Purpose Uses

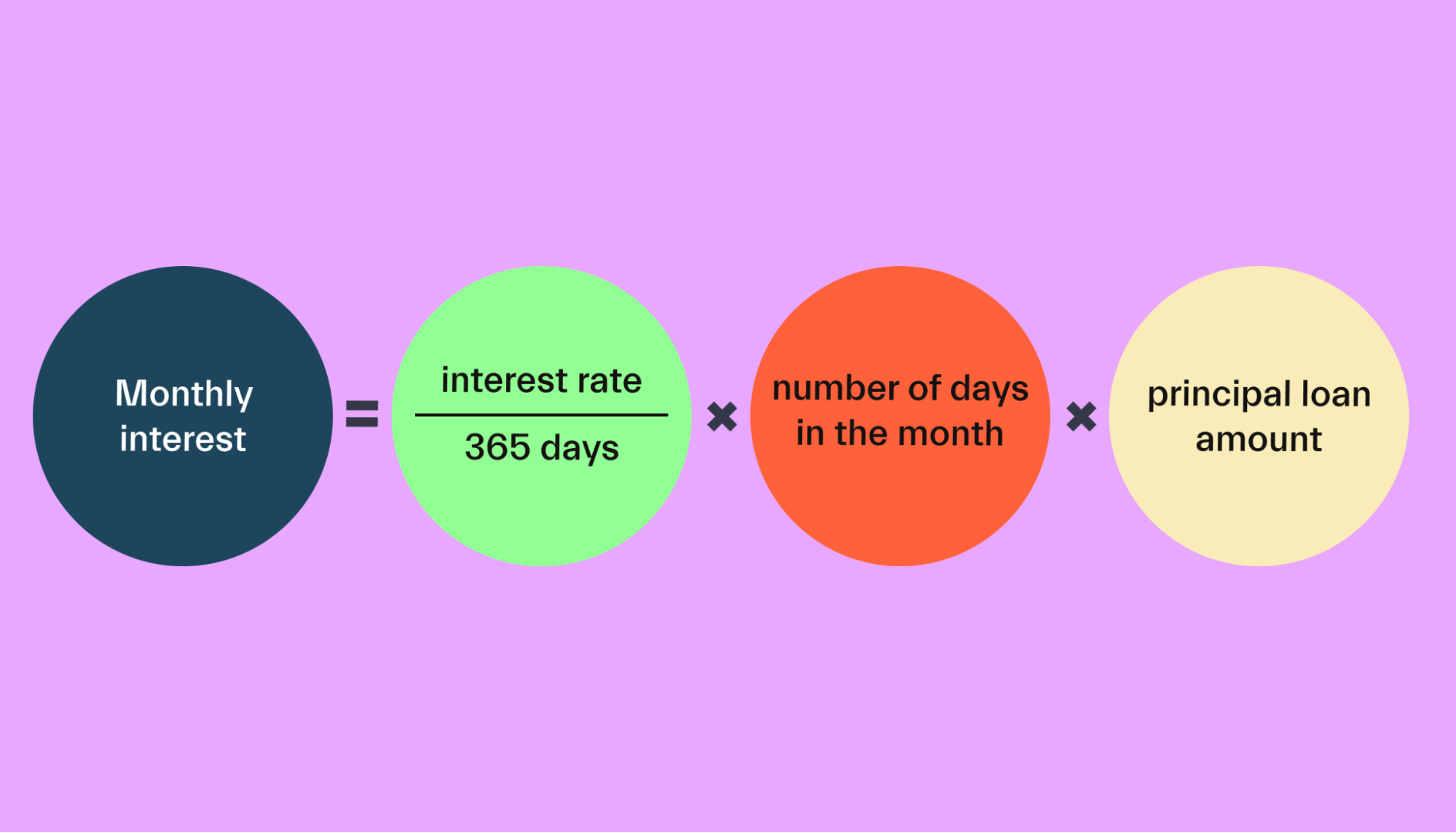

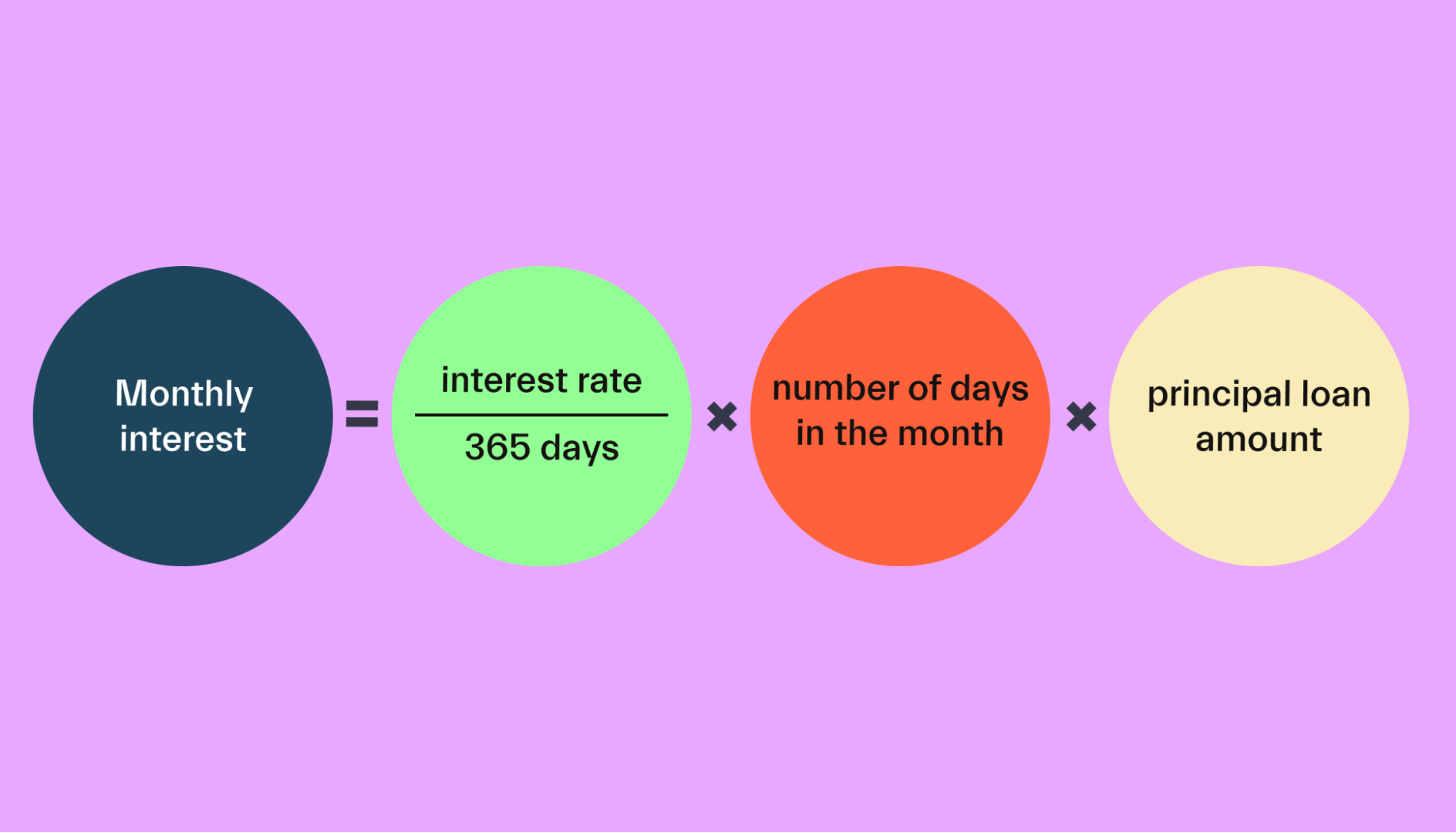

Simple interest principal x interest rate x number of years.

. So if you borrow 100000 with a 15-year term and 3 interest rate your calculation would look like this. 4 beds 3 baths 2012 sq. So if you owe 300000 on your mortgage.

Your principal is the money that you originally agreed to pay back. If you borrow 1200 at a 5 annual interest rate how long will it take for the total amount owed to reach 1300. Find the interest and the amount he has to pay at the end of a year.

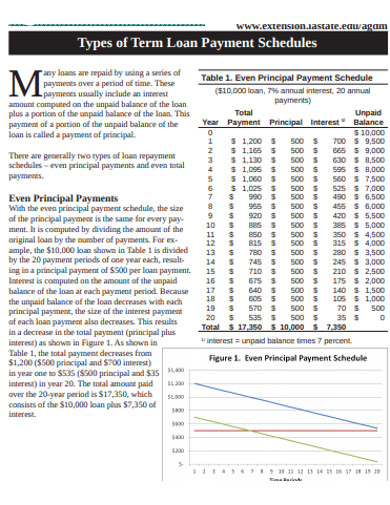

Of that 300 payment 15833 would go toward interest and 14167 would go toward the principal balance. Come take a look at the beautiful 4 bedroom and 3. House located at 18 Principal Pt Dallas GA 30132 sold for 355000 on Jun 7 2022.

For instance in the first year of a 30-year 250000 mortgage with a fixed 5 interest rate 1241624 of your payments goes toward interest and only 368841 goes. Using an online mortgage principal and interest calculator also just called a mortgage calculator you can see how much paying 3 interest on your loan balance over 30. However youre paying off a bigger portion of the principal meaning 78682.

Lenders multiply your outstanding balance by your annual interest rate but divide by 12 because you are making monthly payments. Principal and interest defined According to the Consumer Financial Protection Bureau CFPB Principal is the money that you originally agreed to pay back. For example if the interest rate on a 100000 mortgage is 6.

Here the loan sum P Rs 10000 Rate of interest per year R 10 Time. Interest is a fee paid to the lender for borrowing money typically based on an Annual Percentage Rate APR. On a 15-month CD todays best interest rate is 276.

Interest is the cost of borrowing the principal. The rate of interest is 10 per annum. Multiplying 193000 by the interest rate 004 12 months the interest portion of the payment is now only 64543.

It can also be described alternatively. Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. The principal on your loan is the amount you get from your lender.

Define Class A-18 Principal Loss Amount. The APR is a certain percentage of the total principal balance.

Compound Interest Activity

Compounding Interest And Future Value Worksheet

Simple Interest Online Worksheet

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

What Is A Stafford Loan

Interest Capping Event Bypassed R Pslf

Pin On Ideas

Real Estate Technology Realtor Com Economic Research

Hannah Barnes Iamhannahbarnes Twitter

5 Money Moves To Make Before The Fed Hikes Interest Rates Money

Best 18 Month Interest Free Credit Cards

How To Explain Compound Interest To Kids Moneysense

Loan Schedule 15 Examples Format Pdf Examples

Messenger

Lorna Parks Lornaparks Twitter

I Bonds Explained Why Interest Rates Will Hit Record High Money

Best 18 Month Interest Free Credit Cards